MEMBERS ONLY

Is There Any Hope for the Beaten Down Stocks?

by John Hopkins,

President and Co-founder, EarningsBeats.com

The carnage in the market, which has resulted from the 30% decline in the NASDAQ since its November 22, 2021 high, is going to be remembered for a long time, especially by those who painfully held on to stocks that, in some cases, fell 50% or more from their all-time...

READ MORE

MEMBERS ONLY

Earnings Hits and Misses Present New Opportunities

by John Hopkins,

President and Co-founder, EarningsBeats.com

Over the past two weeks, we have heard from many of the most visible companies in the world, including the FAANG stocks, Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX) and Google (GOOGL), who reported their Q1 earnings. The overall market reaction to the reports was mixed with traders particularly...

READ MORE

MEMBERS ONLY

Finding Opportunities as Earnings Season Kicks into High Gear

by John Hopkins,

President and Co-founder, EarningsBeats.com

It's that time of the year, Q1 Earnings Season, when thousands of companies reveal their numbers, including the good, the bad and the ugly. We've already seen a bit of everything, but that will pale in comparison to what is about to happen, with companies like...

READ MORE

MEMBERS ONLY

A Winning Strategy During Earnings Season

by John Hopkins,

President and Co-founder, EarningsBeats.com

In this extremely volatile market, it pays to develop a trading strategy that can work in any market environment. And with Q1 Earnings getting ready to heat up in just a week or two, this, in turn, should provide traders with a ton of opportunities to make money through focusing...

READ MORE

MEMBERS ONLY

Preserving Capital in a Challenging Environment

by John Hopkins,

President and Co-founder, EarningsBeats.com

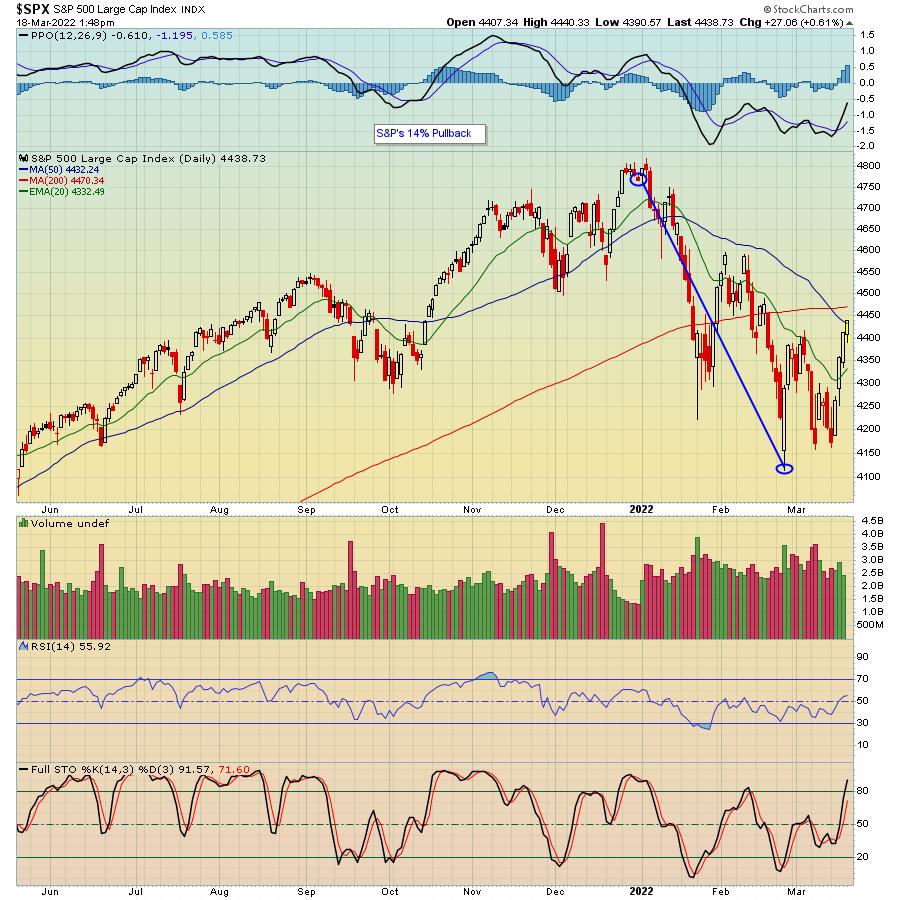

Back on December 31, 2021, our Chief Market Strategist Tom Bowley penned a ChartWatchers article titled "It Could be a Very Rough Start to 2022". Boy, was he right! In fact, look at the two charts below, showing the performance of both the S&P and NASDAQ...

READ MORE

MEMBERS ONLY

A Few Diamonds in the Rough

by John Hopkins,

President and Co-founder, EarningsBeats.com

With the market in turmoil and volatility at a very high level, traders continue to be stymied -- it's tough to make any money unless you are decidedly short. But, underneath the surface there are still some stocks that continue to perform extremely well, or could be close...

READ MORE

MEMBERS ONLY

As the Market's Wild Ride Continued, I Did Some Shopping

by John Hopkins,

President and Co-founder, EarningsBeats.com

I sat down to write my article Friday morning and each time I thought I had the right headline -- I didn't!

You see, it's different when the market is green, the VIX is calm, all is well. It's another thing when the NASDAQ...

READ MORE

MEMBERS ONLY

As Earnings Season Begins, Opportunities Abound

by John Hopkins,

President and Co-founder, EarningsBeats.com

All we've been hearing about lately are Fed rate increases and inflation. This has, in turn, cast a cloud over the market as many traders head to the sidelines. But, from my perspective, the recent pullback in the market has created some unbelievable opportunities in beaten-down stocks. Case...

READ MORE

MEMBERS ONLY

Theme of 2021? Market Resilience. Theme for 2022? TBD

by John Hopkins,

President and Co-founder, EarningsBeats.com

When the S&P hit a record high on November 22, then proceeded to fall over 5% in just over a week, a lot of pundits declared the market was dead. The S&P had simply risen too much for the year and fallen below key technical levels,...

READ MORE

MEMBERS ONLY

Retail Sector Could Hold the Key to a Santa Claus Rally

by John Hopkins,

President and Co-founder, EarningsBeats.com

The market has been under pressure the past several weeks after all of the major indexes hit record highs during November. The NASDAQ has particularly had a tough time getting back on track and it's hard to imagine any Santa Claus rally without the participation of tech stocks....

READ MORE

MEMBERS ONLY

Trouble Ahead? Or Just a Hiccup?

by John Hopkins,

President and Co-founder, EarningsBeats.com

The news that a new variant has popped up spooked the market on Friday, with all of the major indexes getting hit hard. But the truth is the market had gotten overextended and really was in need of a pullback. It just so happens to be that the news about...

READ MORE

MEMBERS ONLY

Top Stock Picks Revealed

by John Hopkins,

President and Co-founder, EarningsBeats.com

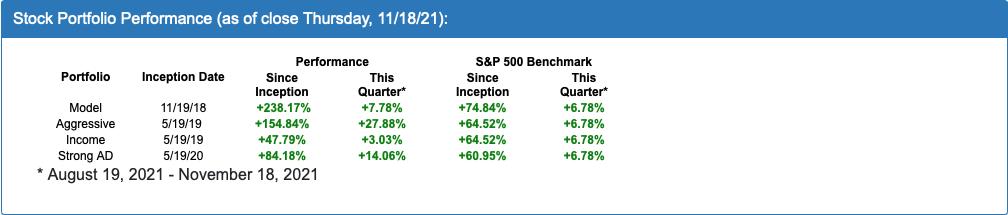

This past Thursday evening, our Chief Market Strategist Tom Bowley unveiled his "Top 10 Stock Picks" for our 4 portfolios, 40 stocks in all. These stocks are meant to be held for the subsequent 90 days, when a new batch of stocks will be unveiled and the process...

READ MORE

MEMBERS ONLY

A Key Technical Indicator That Could Make You Money

by John Hopkins,

President and Co-founder, EarningsBeats.com

Like many traders, I have a few "go to" technical indicators I rely on when making trading decisions. One that I have found to be extremely useful over the years is the Relative Strength Index, better known as the "RSI".

Investopedia says, "The Relative Strength...

READ MORE

MEMBERS ONLY

Earnings Season Presents Great Buying Opportunities

by John Hopkins,

President and Co-founder, EarningsBeats.com

Tesla (TSLA) reported its earnings last week with the stock getting a nice boost in spite of a steady move higher since its mid May low. In fact, the company notched an all-time high on Friday as it exceeded $900 for the first time.

TSLA wasn't the only...

READ MORE

MEMBERS ONLY

Let Charts Help You Identify Possible Winners - And Losers

by John Hopkins,

President and Co-founder, EarningsBeats.com

With Q3 earnings season kicking off over the next few weeks, it's important to try to identify those companies that might shine and those that might suffer once they release their earnings. It's true that you cannot rely solely on one company's chart to...

READ MORE

MEMBERS ONLY

Profiting on Stocks After Earnings

by John Hopkins,

President and Co-founder, EarningsBeats.com

On September 9, Affirm Holdings (AFRM) reported its earnings results after the bell. The market liked what they heard and saw, with the stock climbing a nifty 37.5% from the prior day's close to the high the day after the numbers were released.

If you owned the...

READ MORE

MEMBERS ONLY

How to Profit from Strong Earnings Reports While Reducing Risk

by John Hopkins,

President and Co-founder, EarningsBeats.com

For a very long time, I have avoided holding stocks that I own into an earnings report. I should explain that I am more of a short-term trader, so I don't like the risk that goes along with holding a stock when they are about to report. And...

READ MORE

MEMBERS ONLY

AMD Shows Patience is a Virtue as Opportunities Abound

by John Hopkins,

President and Co-founder, EarningsBeats.com

In my last ChartWatchers article, I discussed ways to profit from the terrific earnings season that we just experienced. So many companies put up solid numbers which led to the market reaching an all-time high.

I'm referencing my article from two weeks ago because it's a...

READ MORE

MEMBERS ONLY

How to Profit from a Great Earnings Season

by John Hopkins,

President and Co-founder, EarningsBeats.com

Q2 Earnings season is winding down and, based on the record highs on all of the major indexes this past week, traders liked what they heard and saw.

The solid earnings beats by many companies comes as no surprise, with interest rates remaining low while the Fed continues its bullish...

READ MORE

MEMBERS ONLY

This is Why You MUST Follow Relative Strength Heading into Earnings

by John Hopkins,

President and Co-founder, EarningsBeats.com

If you have been paying attention to earnings, you would have seen that SNAP reported their numbers on Thursday and crushed all expectations. As a result, the stock was higher by over 25% at its peak the day after the numbers were released.

While you might not have benefited from...

READ MORE

MEMBERS ONLY

The IYW Shines -- See Why

by John Hopkins,

President and Co-founder, EarningsBeats.com

The IYW is a US Technology ETF. Its three largest holdings are AAPL, MSFT and GOOGL. At its peak this past Wednesday, it was higher by 9.4% from the date it was added to our ETF Model portfolio on April 19, compared to the S&P of 5....

READ MORE

MEMBERS ONLY

Are Nike's Earnings Results a Precursor of What is About to Come?

by John Hopkins,

President and Co-founder, EarningsBeats.com

Nike (NKE) reported blowout earnings Thursday after the bell and the market liked what it heard and saw, with the stock rising by 15% when it opened for trading on Friday. The company smashed all expectations and even guided higher, a combo that launched it to an all-time high.

Of...

READ MORE

MEMBERS ONLY

Shorts Get Cooked Again!

by John Hopkins,

President and Co-founder, EarningsBeats.com

The Reddit crowd was at it again this past week as they mounted a full-out assault on short sellers, with some stocks making meteoric rises. The biggest example was AMC Entertainment (AMC), which tripled - repeat; tripled - over a one week period, rising from just over $12 to almost...

READ MORE

MEMBERS ONLY

How to Best Position Yourself For a Rocky Market Ahead

by John Hopkins,

President and Co-founder, EarningsBeats.com

The volatility we've seen in the market of late can be linked to some recent reports showing that inflationary concerns are becoming problematic. More specifically, the Labor Department reported that CPI rose by 0.8%, while the rate of inflation over the past year climbed 4.2% in...

READ MORE

MEMBERS ONLY

Strong Earnings = Fresh Opportunities to Make Money

by John Hopkins,

President and Co-founder, EarningsBeats.com

Last week was chock-full of blockbuster earnings reports, including AAPL, AMZN, FB, GOOGL and MSFT. Together, those five companies have a combined market cap of over $8 trillion. That's a lot of earnings fire power! Overall, the five companies in total had superb earnings including top line, bottom...

READ MORE

MEMBERS ONLY

Which ETFs Currently Provide the Best Opportunities?

by John Hopkins,

President and Co-founder, EarningsBeats.com

Some traders focus all of their time, capital and attention on individual stocks. This can be a double-edged sword. On the one hand, focusing on individual stocks can produce outsized gains. But, of course, the opposite is also true; a trade gone bad on an individual stock can be financially...

READ MORE

MEMBERS ONLY

This Company Smashed Earnings Expectations

by John Hopkins,

President and Co-founder, EarningsBeats.com

Williams Sonoma, Inc (WSM) reported their earnings this past week and proved that, even in a choppy market environment, strong earnings can be rewarded. In fact, look at the chart below, which shows the stock spiking a nifty 30% in just two days as traders cheered their performance.

WSM had...

READ MORE

MEMBERS ONLY

Here's a Stock That Deserves Your Attention

by John Hopkins,

President and Co-founder, EarningsBeats.com

Everyone is giving up on growth stocks, especially given the sharp rise in rates, with the 10 Year US Treasury Note rising as high as 1.62% on Friday. And now, any good news - i.e., a solid jobs report - is seen as bad news, with concerns of...

READ MORE

MEMBERS ONLY

GME, GME and... GME

by John Hopkins,

President and Co-founder, EarningsBeats.com

While the overall market was working its way to new highs, the entire investing world (and many who had never been involved in the market before) was tuning in daily to see what the price of Gamestop (GME) was. A stock that was trading at just over $19 a share...

READ MORE

MEMBERS ONLY

NFLX Knocks it Out of the Park - Who Will Be Next?

by John Hopkins,

President and Co-founder, EarningsBeats.com

Earnings season is off to the races, with Netflix (NFLX) flexing its muscles last week as it beat expectations all the way around, rising 18% at its peak the day after its numbers were released.

Netflix isn't the only company to report strong earnings. JP Morgan (JPM) and...

READ MORE

MEMBERS ONLY

Building a Strong ETF Portfolio to Beat the S&P

by John Hopkins,

President and Co-founder, EarningsBeats.com

In my last ChartWatchers article, I mentioned that we had started a new ETF feature of the EarningsBeats.com service. This new feature is meant for those individuals who are interested in putting capital to work in ETFs as part of their trading strategy.

Our first ETF Portfolio consisted of...

READ MORE

MEMBERS ONLY

This ETF Has Skyrocketed 58% in Just Two Months

by John Hopkins,

President and Co-founder, EarningsBeats.com

A lot of traders opt for individual stocks when looking for outsized gains. But ETFs can produce great gains as well if you are able to identify which ones are poised to rise.

As an example, take a look at the chart below on the Clean Energy ETF, PBW.

As...

READ MORE

MEMBERS ONLY

Stocks That Rock During December!

by John Hopkins,

President and Co-founder, EarningsBeats.com

At EarningsBeats.com, we created a list of stocks that are historically among the best-performing ones during the month of December. This list was created on November 30 and one of the companies on the list, Seagate Technology Holdings (STX), has not disappointed.

As you can see, so far this...

READ MORE

MEMBERS ONLY

Current Rotation Leading to Massive Short Squeeze Trades

by John Hopkins,

President and Co-founder, EarningsBeats.com

The market rotation of late has resulted in some explosive moves in some "forgotten stocks." This has been particularly true of those stocks that have a high percentage of shares short.

As an example, take a look at the two charts below. Both of these stocks are on...

READ MORE

MEMBERS ONLY

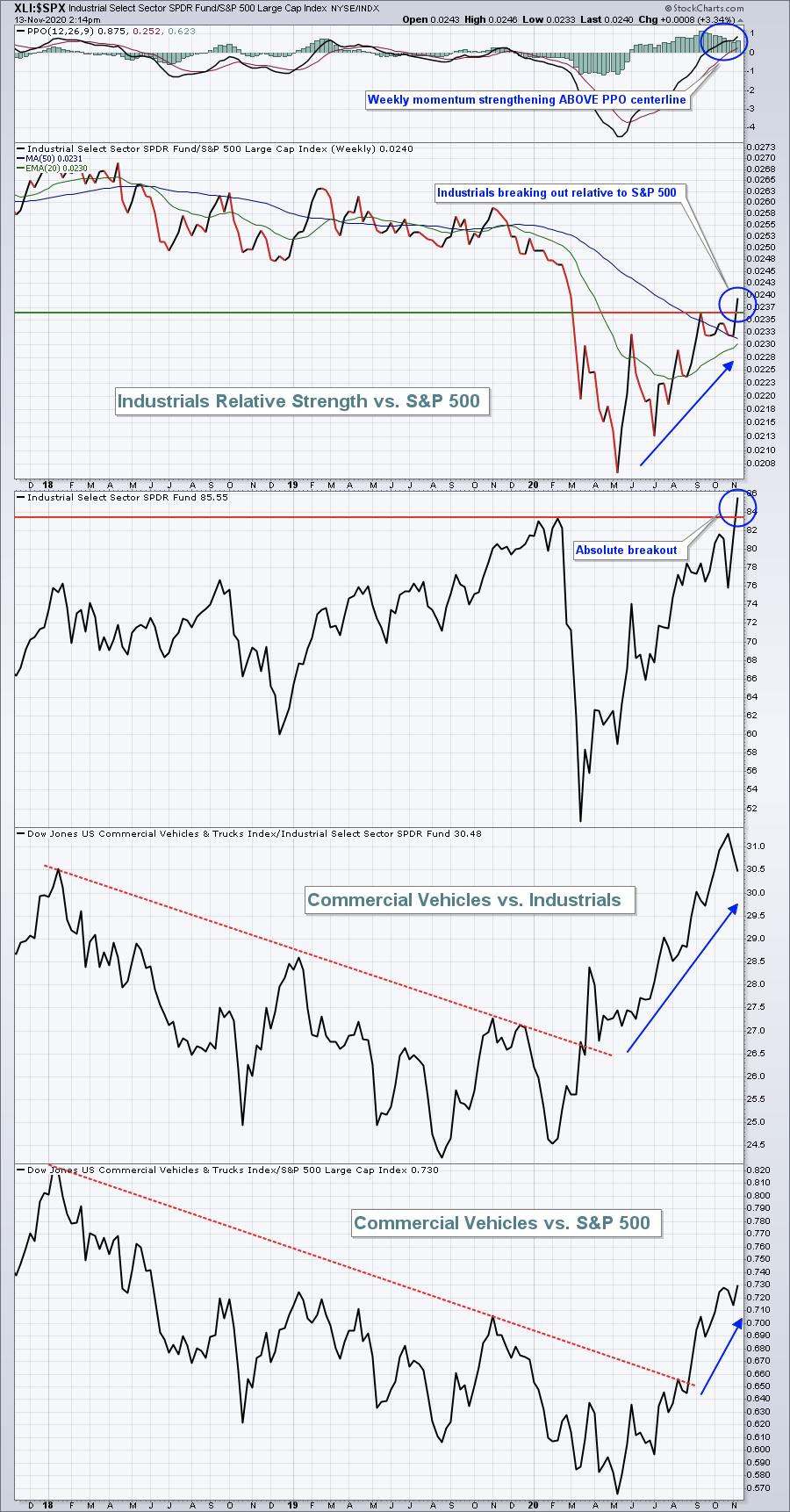

It's Early, But Rotation is SCREAMING to Buy This Sector!

by John Hopkins,

President and Co-founder, EarningsBeats.com

This past week, we saw traders turning their attention away from some of the high-flying "Stay at Home" tech stocks to some other sectors that could fare well if the recently announced COVID vaccines have the promising effect that is hoped for. We've certainly noticed the...

READ MORE

MEMBERS ONLY

Two Companies in Internet Sector Report Blowout Numbers - Who Will Be Next?

by John Hopkins,

President and Co-founder, EarningsBeats.com

Earnings season is in full swing and, so far, we've seen some really solid results. That might seem counterintuitive, given the bloodbath of late; however, two companies that recently knocked it out of the park were Snap (SNAP) and Pinterest (PINS).

In the case of SNAP, you can...

READ MORE

MEMBERS ONLY

Here are the 2 Stocks Leading Our Powerful Portfolios

by John Hopkins,

President and Co-founder, EarningsBeats.com

It's very true at the moment that this is a "stock pickers" market, meaning it really makes a big difference which individual stocks you are trading unless you focus more on ETFs. For example, as you can see below, one of the stocks in our "...

READ MORE

MEMBERS ONLY

Profiting on Stocks with High Short Interest

by John Hopkins,

President and Co-founder, EarningsBeats.com

At EarningsBeats.com, we provide our members with various ChartLists of stocks that we believe could give them an upper hand when trading. This includes our Short Squeeze ChartList, which currently has 79 companies that have short percentage of float above 20%. This means that many traders are betting against...

READ MORE

MEMBERS ONLY

Many Stocks Just Got Cheaper - Now What?

by John Hopkins,

President and Co-founder, EarningsBeats.com

Anyone who has followed the market like I have through every possible scenario, from the dot-com bubble to 9/11 to the Great Recession to what we've seen the past few days, should have recognized that the market was getting VERY extended. When you start seeing Stochastics near...

READ MORE

MEMBERS ONLY

Powerful Scanning Strategies for Our Strong Earnings ChartList

by John Hopkins,

President and Co-founder, EarningsBeats.com

It's been a very exciting time for the bulls, with the NASDAQ and S&P hitting all-time highs this week. In fact, for those who have been skeptical and sat out the move off of the March 21 bottom, this has been painful to watch, with the...

READ MORE