MEMBERS ONLY

Unlock the Power of StockCharts' NEW Market Summary Dashboard | Walkthrough & Tips

by Grayson Roze,

Chief Strategist, StockCharts.com

In this in-depth walkthrough, Grayson introduces the brand-new Market Summary Dashboard, an all-in-one resource designed to help you analyze the market with ease, speed, and depth. Follow along as Grayson shows how to take advantage of panels, mini-charts, and quick scroll menus to maximize your StockCharts experience.

This video originally...

READ MORE

MEMBERS ONLY

Navigating Earnings: Three Stocks, Three Different Stories

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

KEY TAKEAWAYS

* Short-term traders may find an opportunity in Under Armour stock if the price breaks above key resistance.

* Walmart earnings could reveal how retail spending is trending.

* Alibaba's stock price sits in a volatile range with trade tensions and AI investments playing a critial role in its...

READ MORE

MEMBERS ONLY

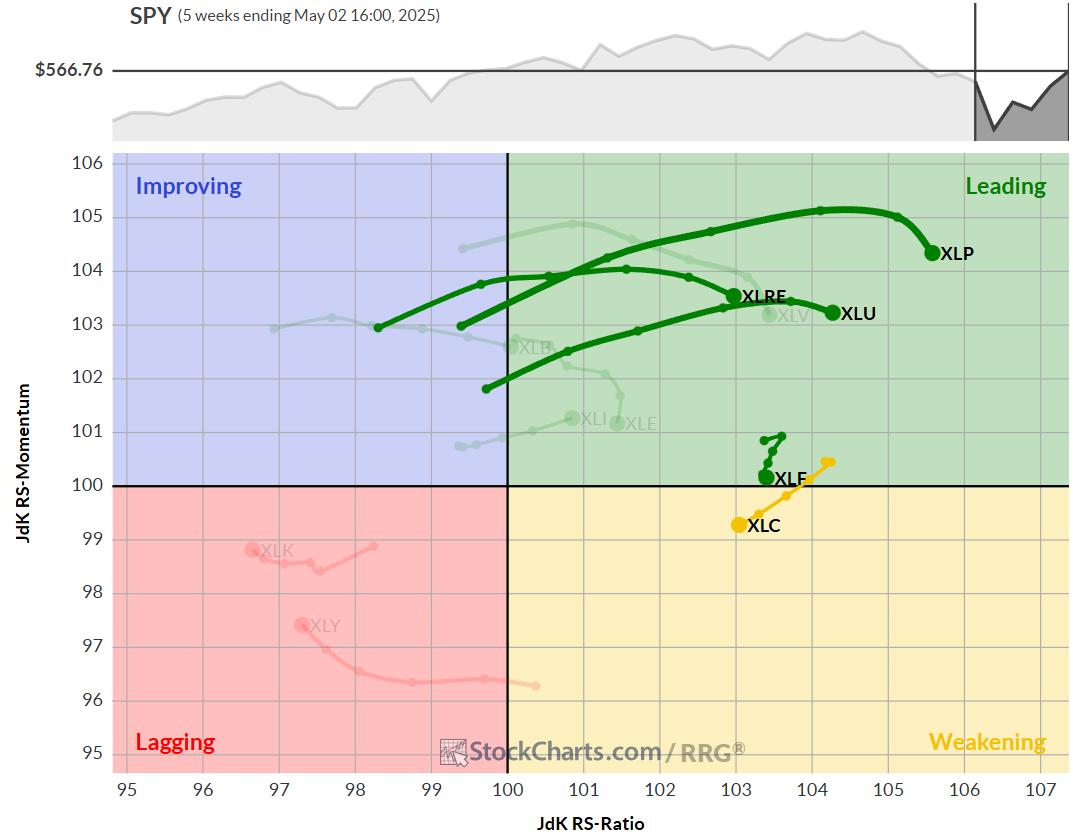

The Best Five Sectors, #18

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* All 11 sectors changed positions, but the top-5 / bottom-6 composition remained the same.

* Utilities now strongest sector, despite overall market strength.

* Communication Services jumped from 5th to 2nd place.

* Portfolio still 3% behind the S&P 500 YTD, unchanged from last week.

Sector Shuffle: Same Players, New...

READ MORE

MEMBERS ONLY

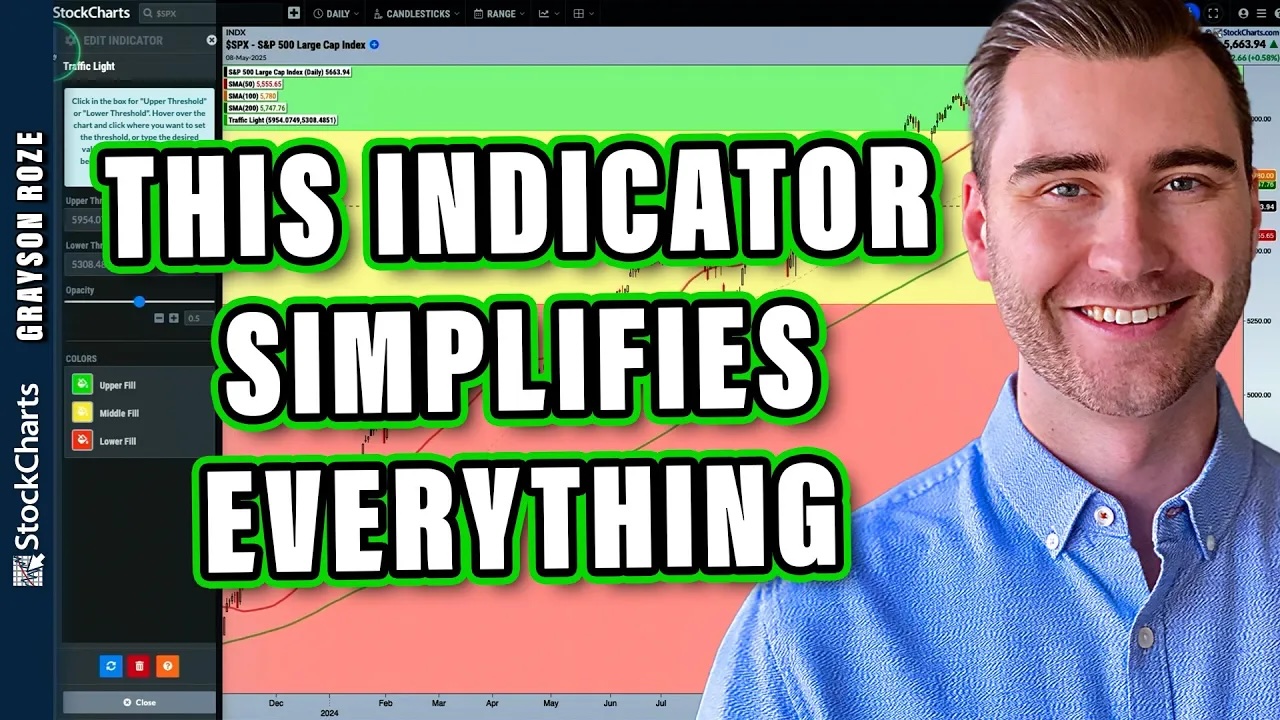

Confused by the Market? Let the Traffic Light Indicator Guide You

by Grayson Roze,

Chief Strategist, StockCharts.com

In this insightful session, Grayson introduces the Traffic Light indicator, a unique tool available exclusively on the Advanced Charting Platform (ACP). Amidst the current volatility of the S&P 500, Grayson demonstrates how this indicator can help investors clarify trend directions and make more confident decisions.

This video originally...

READ MORE

MEMBERS ONLY

Don't Buy Robinhood Stock... Until You See This Chart Setup

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Robinhood's stock price is outpacing its sector and the broader market.

* The Financials sector looks bullish, and HOOD has outperformed it by 250% over 3 years.

* Does HOOD have room to run, or is it running on fumes and FOMO?

Robinhood Markets, Inc. (HOOD) is back...

READ MORE

MEMBERS ONLY

Will Trump's Foreign Film Tariffs Crush Streaming Stocks? What You Need To Know Now

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Trump's proposed 100% tariffs on foreign films are now disrupting streaming media stocks.

* Pure-play stocks are responding differently, with Netflix, the most exposed to tariff risk, outperforming all others.

* Any technical or fundamental trade setup is subject to geopolitical dynamics; so be cautious!

Trump's...

READ MORE

MEMBERS ONLY

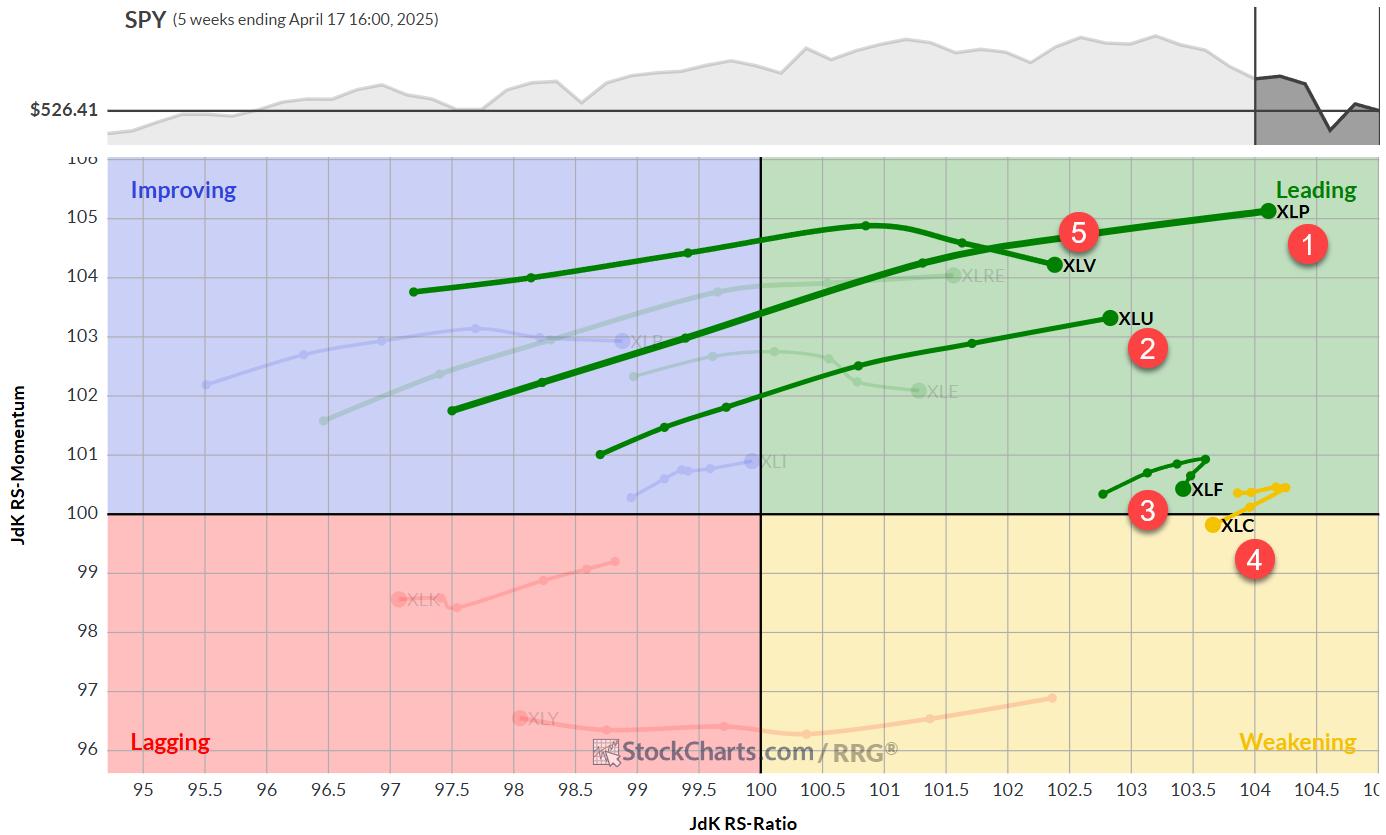

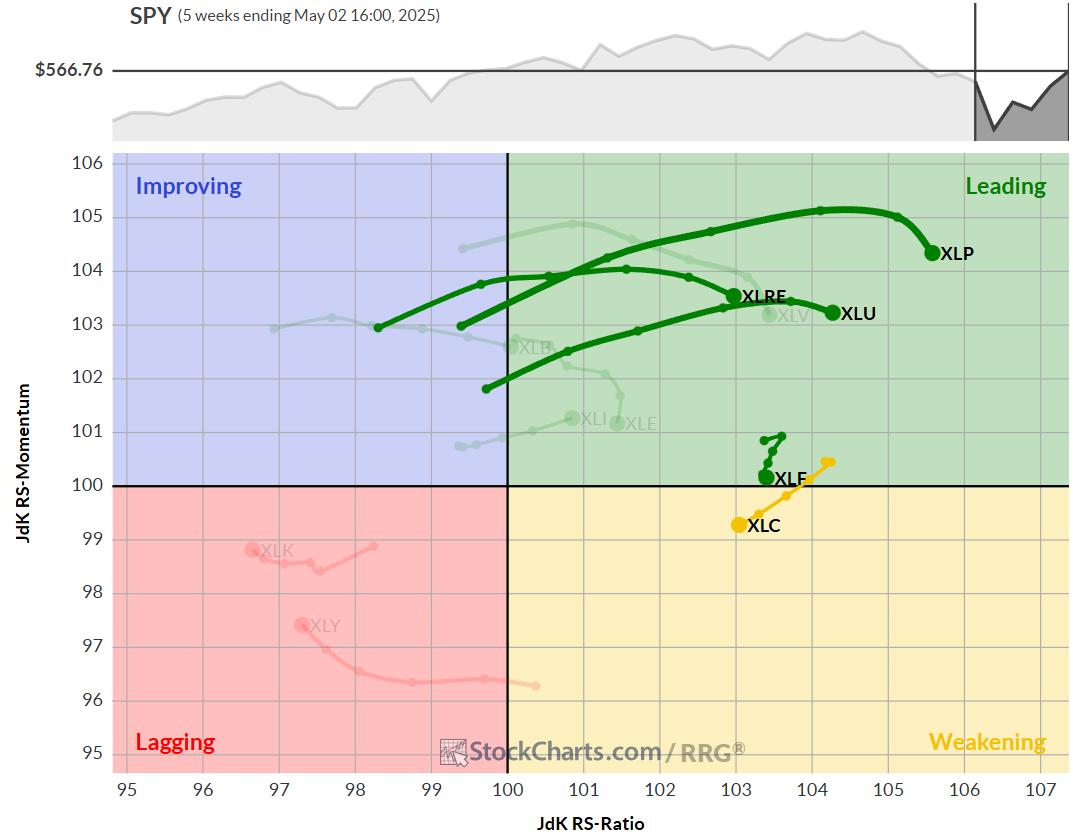

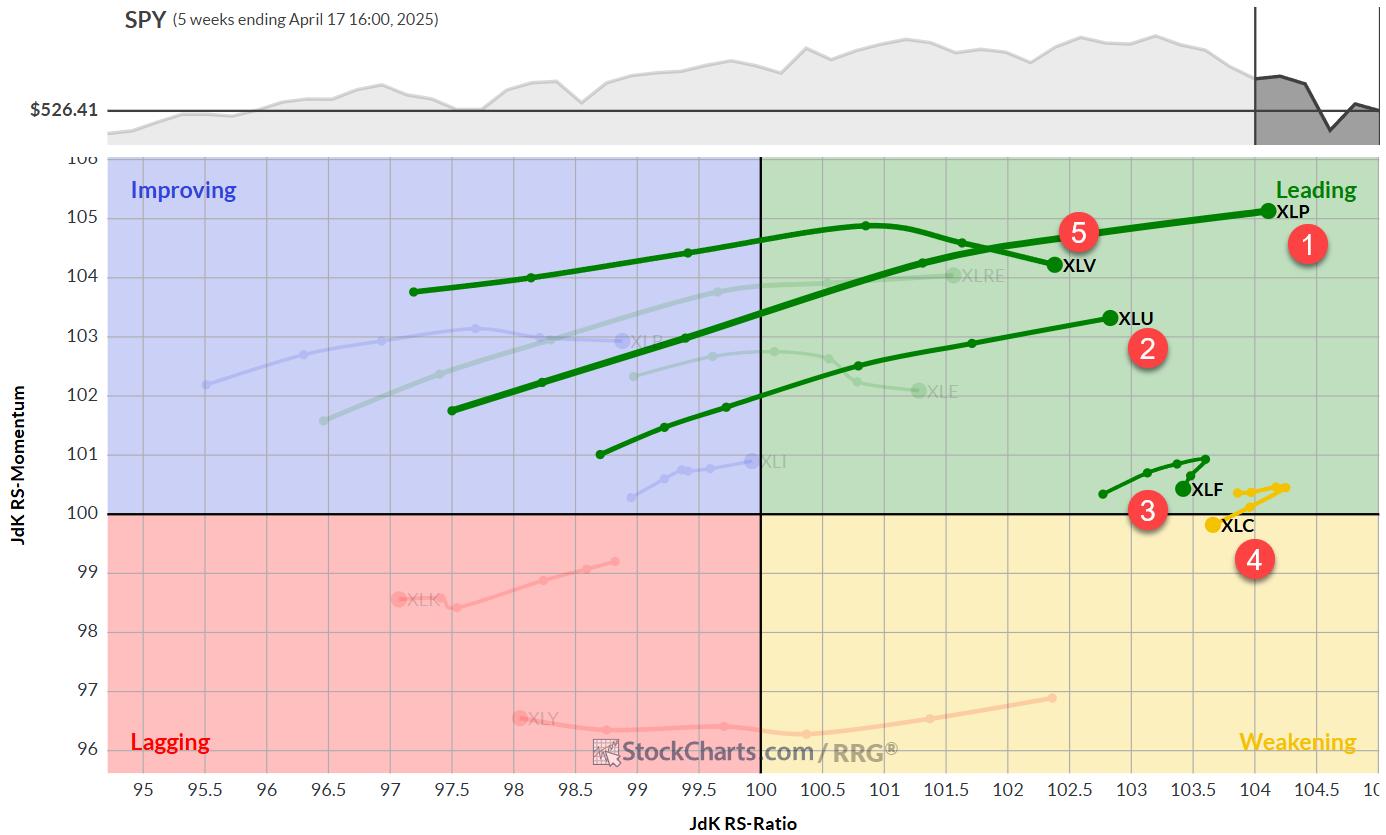

The Best Five Sectors, #18

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Top 5 sectors remain unchanged, with minor position shifts

* Leading sectors showing signs of losing momentum

* Daily RRG reveals top sectors in weakening quadrant

* Communication services at risk of dropping out of top 5

Communication Services Drops to #5

The composition of the top five sectors remains largely...

READ MORE

MEMBERS ONLY

The Easiest Road to Supercharge Your Investing Reflexes and Reactions!

by Gatis Roze,

Author, "Tensile Trading"

Riches are found in reactions—your reactions to changes in the markets. By this, I mean that if you spot a change in money flowing from one asset class to another, one sector to another, one industry to another, before the masses notice, you will be rewarded handsomely. My experience...

READ MORE

MEMBERS ONLY

Stocks In Focus This Week: Palantir, Uber, and Coinbase

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

KEY TAKEAWAYS

* Palantir stock nears breakout as AI revenue and government contracts drive growth.

* Uber stock signals strength ahead of earnings report.

* Coinbase eyes reversal as crypto trading volume increases.

This week, we're watching three high-profile names--Palantir (PLTR), Uber (UBER), and Coinbase (COIN)--as they gear up for...

READ MORE

MEMBERS ONLY

Top 10 Stock Charts For May 2025: Breakouts, Trends & Big Moves!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

Discover the top 10 stock charts to watch this month with Grayson Roze and David Keller, CMT. They break down breakout strategies, moving average setups, and technical analysis strategies using relative strength, momentum, and trend-following indicators. This analysis covers key market trends that could impact your trading decisions. You don&...

READ MORE

MEMBERS ONLY

The Hidden Meaning Behind the Tech Sector's Rally (And How to Spot It)

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Technology stocks are back in the lead, with ETFs like XLK showing notable performance.

* MarketCarpets gives you a quick snapshot of sector trends and market breadth.

* Indicators like the Bullish Percent Index and CMF suggest XLK may be approaching overbought territory, highlighting the need to be cautious.

When...

READ MORE

MEMBERS ONLY

The SCTR Report: Why PLTR Stock Remains a Top Contender in a Volatile Market

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* PLTR stock dropped sharply in February 2025 but rebounded in April, thanks to easing trade tensions and new government contracts.

* RSI and Accumulation/Distribution Line (ADL) suggest bullish momentum, but valuations remain stretched.

* Watch the May 5 earnings report and geopolitical developments for PLTR stock's next...

READ MORE

MEMBERS ONLY

Ready To Level Up Your Options Trading?

by Tony Zhang,

Chief Strategist, OptionsPlay

Grow your trading account using proven options strategies, right from your StockCharts ChartLists, with the help of this powerful educational webinar!

In this session, Tony Zhang, Chief Strategist of OptionsPlay, will show you how to:

* Scan your ChartLists for top-performing trade setups

* Identify income-generating and directional opportunities

* Use OptionPlay'...

READ MORE

MEMBERS ONLY

Personalized Options Trading Strategies: Discover High-Yield Covered Calls and Spreads with the OptionsPlay Add-On

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* OptionsPlay now integrates with your StockCharts ChartLists.

* Focus on only the most promising setups tailored to your directional bias and risk tolerance.

* Make faster, smarter, and personalized trading decisions with the OptionsPlay Add-On.

If you've been exploring ways to take your options trading to the next...

READ MORE

MEMBERS ONLY

Our Very Last Trading Room

by Erin Swenlin,

Vice President, DecisionPoint.com

Today, Carl and Erin made a big announcement! They are retiring at the end of June so today was the last free DecisionPoint Trading Room. It has been our pleasure educating you over the years and your participation in the trading room has been fantastic! Be sure and sign up...

READ MORE

MEMBERS ONLY

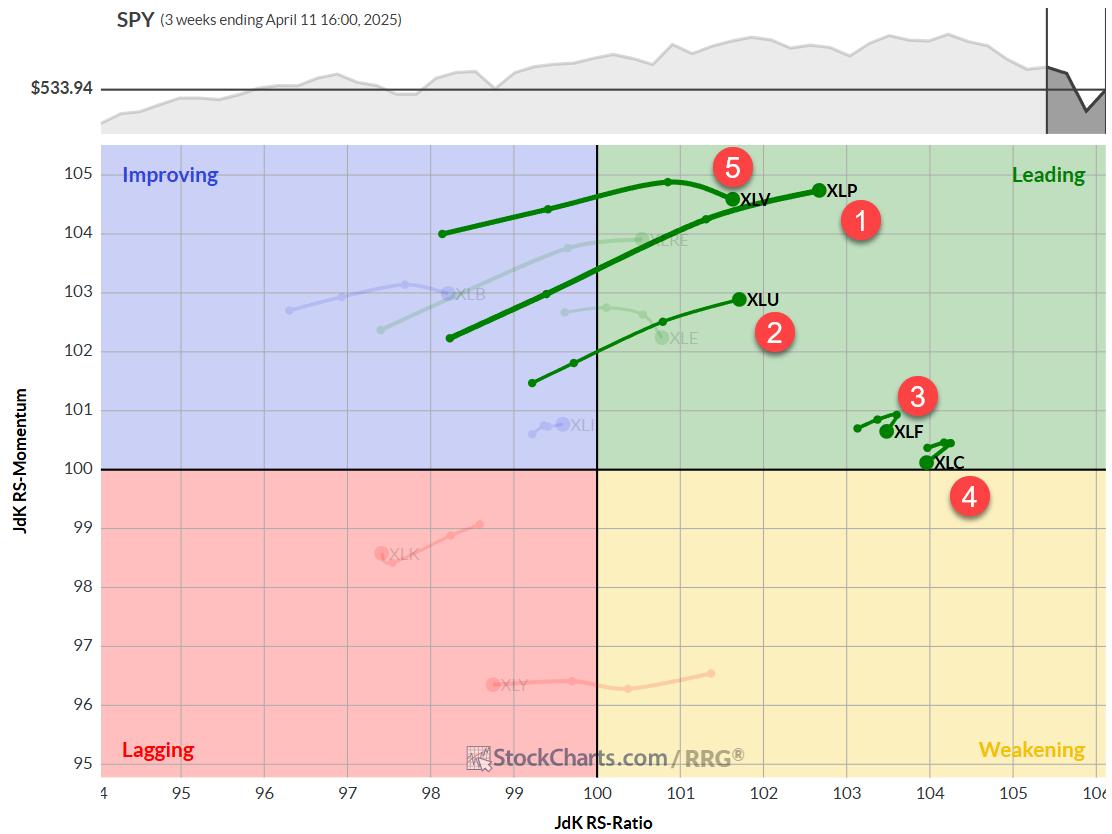

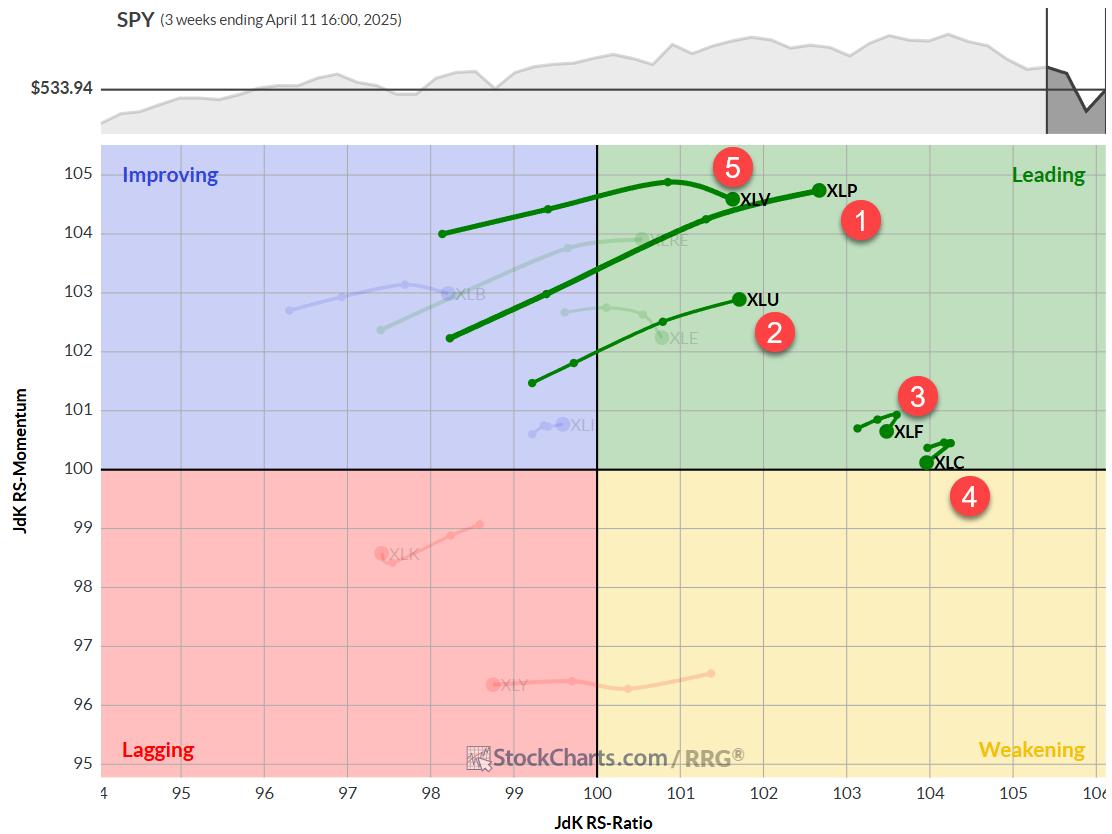

The Best Five Sectors, #17

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Defensive sectors maintain dominance in top 5, despite strong market performance.

* Real Estate enters top 5, replacing Health Care; Consumer Staples, Utilities, and Financials remain stable in top 3 positions.

* Defensive positioning has put a dent in portfolio performance after strong week.

Real Estate and Healthcare Swapping Positions...

READ MORE

MEMBERS ONLY

Zweig Breadth Thrust Dominates the Headlines - But What about an Exit Strategy?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* S&P 1500 Advance-Decline Percent triggered a Zweig Breadth Thrust this week.

* These signals reflect a sudden and sharp shift in participation (net advancing percent).

* ZBT signals only cover the entry, which means chartists need to consider an exit strategy should it fail.

The Zweig Breadth Thrust...

READ MORE

MEMBERS ONLY

Two EASY Ways to Find the Strongest Stocks in Seconds

by Grayson Roze,

Chief Strategist, StockCharts.com

In this video, Grayson highlights the crucial 5,500 level on the S&P 500 using our "Tactical Timing" chart. He then demonstrates two of the easiest methods for identifying the strongest stocks within key indexes like the S&P 500, NASDAQ 100 and Dow Industrials....

READ MORE

MEMBERS ONLY

Earnings Week in Full Swing: Don't Overlook These Three Stocks

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

This week will be the biggest week of earnings season and yes, all eyes will be on the heavy-hitters: META, AMZN, MSFT, and AAPL. These names dominate headlines, and their charts are practically seared into our brains.

But let's look at some solid companies that might fly under...

READ MORE

MEMBERS ONLY

Real-Time Options Strategies on Your ChartLists? Yes, Please!

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* Real-time options strategy analysis is now ChartList-driven in the OptionsPlay Strategy Center.

* The OptionsPlay Strategy Center adapts to your style and puts hours of analysis at your fingertips—instantly.

If you're like most options traders, you've probably stared at your watchlist or portfolio and...

READ MORE

MEMBERS ONLY

How to Shield Your Stocks During a Market Decline

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* When stock markets decline, you can protect your positions with options.

* Buying puts on stocks you own can help protect your position if the stock falls further.

* A put vertical spread is another strategy to protect your portfolio holdings.

When the stock market is turbulent, it makes sense...

READ MORE

MEMBERS ONLY

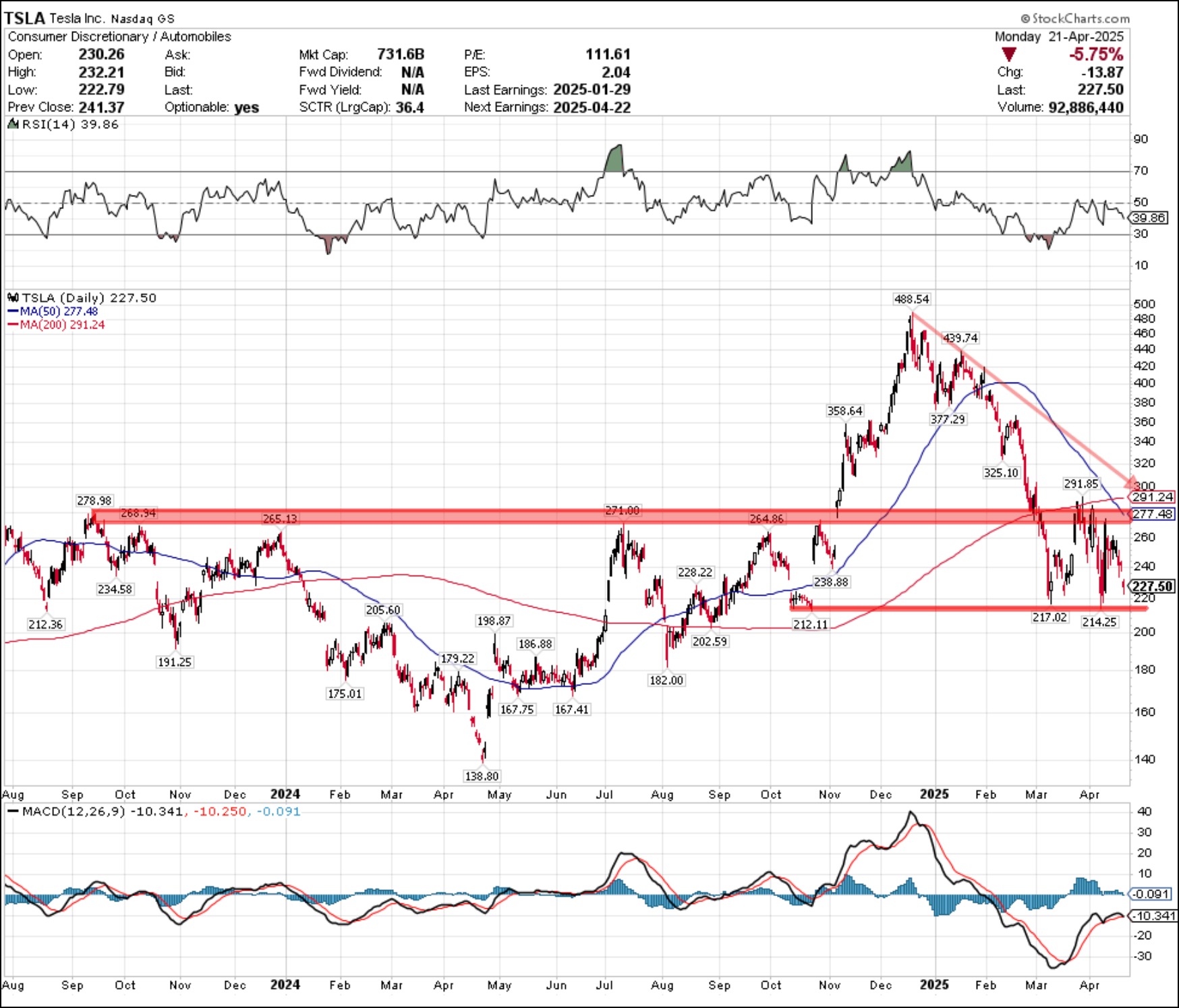

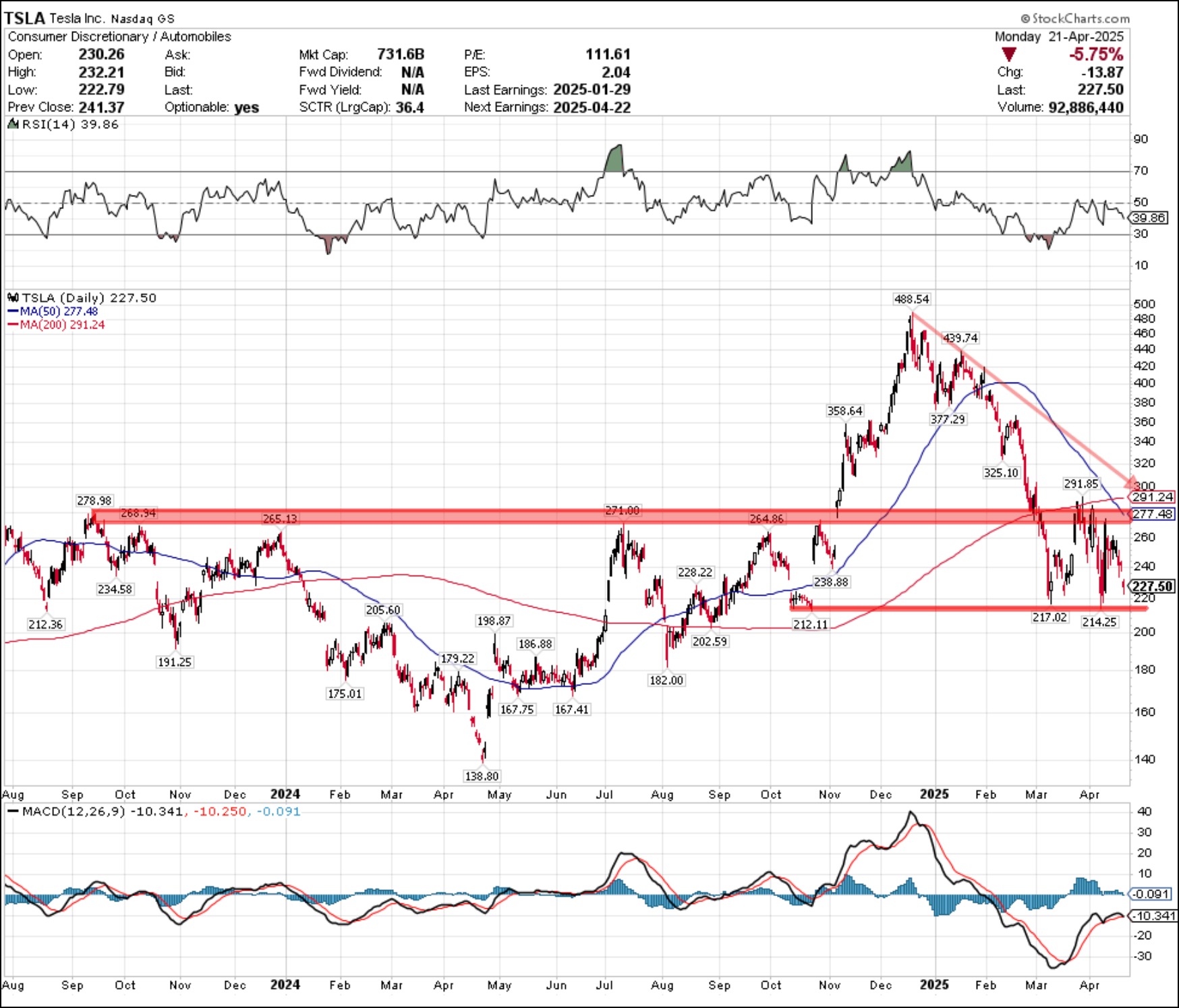

Three Stocks to Watch This Earnings Week

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

KEY TAKEAWAYS

* Tesla's daily chart displays key support levels to monitor after the company reports earnings.

* Service Now is showing signs of a bottom, which could mean a reversal depending on earnings results.

* Watch for Alphabet, Inc. shares to hit specific support levels, which could give traders favorable...

READ MORE

MEMBERS ONLY

Bearish Warning: 3 Market Sentiment Indicators You Can't Ignore

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, market sentiment, investor psychology, and stock market trends take center stage as David Keller, CMT, shares three powerful sentiment indicators that he tracks every week. He explains how the values are derived, what the current readings say about the market environment in April 2025, and how these...

READ MORE

MEMBERS ONLY

DP Trading Room: Long-Term Outlook for Bonds

by Erin Swenlin,

Vice President, DecisionPoint.com

The market continued to slide lower today as the bear market continues to put downside pressure on stocks in general. Bonds and Yields are at an inflection point as more buyers enter the Bond market which is driving treasury yields higher. What is the long-term outlook for Bonds? Carl gives...

READ MORE

MEMBERS ONLY

Safer Stock Picks for an Uncertain Market (High Yield + Growth)

by Mary Ellen McGonagle,

President, MEM Investment Research

In this video, as earnings season heats up, Mary Ellen reviews current stock market trends, highlighting top-performing stocks during past bear markets that are showing strength again today. She also shares a proven market timing system that's signaled every stock market bottom, helping investors stay ahead of major...

READ MORE

MEMBERS ONLY

The Best Five Sectors, #16

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Consumer staples and utilities continue to lead sector rankings.

* Defensive sectors are showing strength in both weekly and daily RRGs.

* Health care struggling, but maintains position in top 5

* RRG portfolio slightly underperforming S&P 500 YTD, but gap narrowing.

Top 5 Remains Unchanged

The latest sector...

READ MORE

MEMBERS ONLY

Breadth Maps Are A Bloodbath, BUT Has The Bounce Begun?

by Grayson Roze,

Chief Strategist, StockCharts.com

In this video, Grayson unveils StockCharts' new Market Summary ChartPack—an incredibly valuable new ChartPack packed full of pre-built charts covering breadth, sentiment, volatility data and MUCH MORE!

From there, Grayson then breaks down what he's seeing on the current Market Summary dashboard, illustrating how he'...

READ MORE

MEMBERS ONLY

How to Time Your Trades For Faster Gains

by Tony Zhang,

Chief Strategist, OptionsPlay

When working with probabilities, you want to place trades that maximize your returns while minimizing your risks.

In this OptionsPlay members-only video, Tony Zhang walks you through the techniques professional traders use to identify optimal entry points. Explore how you can apply those same strategies in the StockCharts.com OptionsPlay...

READ MORE

MEMBERS ONLY

Is This the Confidence Trap That Could Wreck Your Retirement Portfolio?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Despite extreme market volatility, the broader market's uptrend may still be intact.

* Defensive sectors like Consumer Staples and Utilities are flashing bullish signals.

* Defensive sectors don't typically drive uptrends so, depending on your time horizon, you will need to create an appropriate strategy.

If...

READ MORE

MEMBERS ONLY

DP Trading Room: SPX Earnings Update

by Erin Swenlin,

Vice President, DecisionPoint.com

The market has been overvalued for some time but how overvalued is it? Today Carl brings his earnings chart to demonstrate how overvalued the market is right now. We have the final data for Q4 2024.

The market continues to show high volatility but it did calm down somewhat Monday....

READ MORE

MEMBERS ONLY

The Best Five Sectors, #15

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The entire top 5 has now changed positions.

* All defensive sectors are now in the top 5, while Healthcare has reentered.

* Portfolio is now lagging S&P 500.

Healthcare Re-Enters the Top 5

After a wild week in the markets, the sector ranking got quite a shake-up....

READ MORE

MEMBERS ONLY

An Oversold Bounce is One Thing - A Bullish Breadth Thrust is Another

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Price and breadth fell to extremes in early April as the market panicked.

* These extremes produced an oversold bounce, but this is still within a bear market.

* Follow through is what separates bear market bounces from bullish breadth thrusts.

Panic selling and oversold extremes gave way to a...

READ MORE

MEMBERS ONLY

Earnings From These 3 Stocks Could Be Key

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

This week, we're getting back to earnings season during the shortened four-day period.

Goldman Sachs Group, Inc. (GS) reports on the heels of JP Morgan's solid results that saw its shares rally by 12.3% and recapture its 200-day moving average.

Watch the trading revenue numbers...

READ MORE

MEMBERS ONLY

Master the Market: A Guide to StockCharts' New Market Summary Page

by Grayson Roze,

Chief Strategist, StockCharts.com

Stock market analysis, technical indicators, and market trends are crucial for informed investing. StockCharts is making those things easier, and Grayson Roze is here to show you how.

In this video, Grayson provides an in-depth walk-through of the all-new Market Summary Page. This comprehensive tool offers a top-down overview of...

READ MORE

MEMBERS ONLY

DP Trading Room: Key Support Levels for the SPY

by Erin Swenlin,

Vice President, DecisionPoint.com

The market is in a tailspin as tariffs add volatility to the market. Carl and Erin believe the SPY is in a bear market given key indexes like the Nasdaq are already in bear markets. It's time to consider where the key support levels are.

Carl addressed his...

READ MORE

MEMBERS ONLY

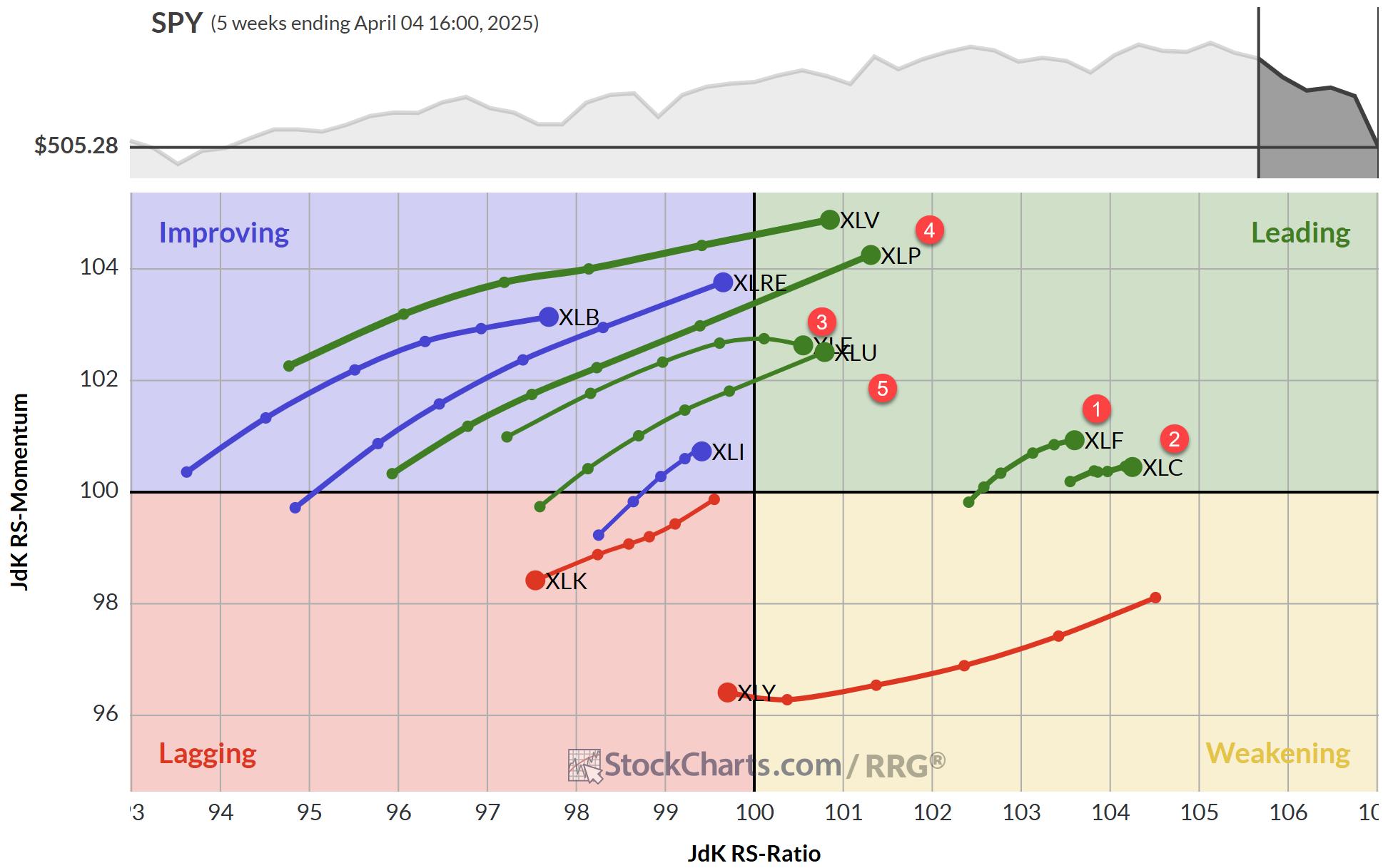

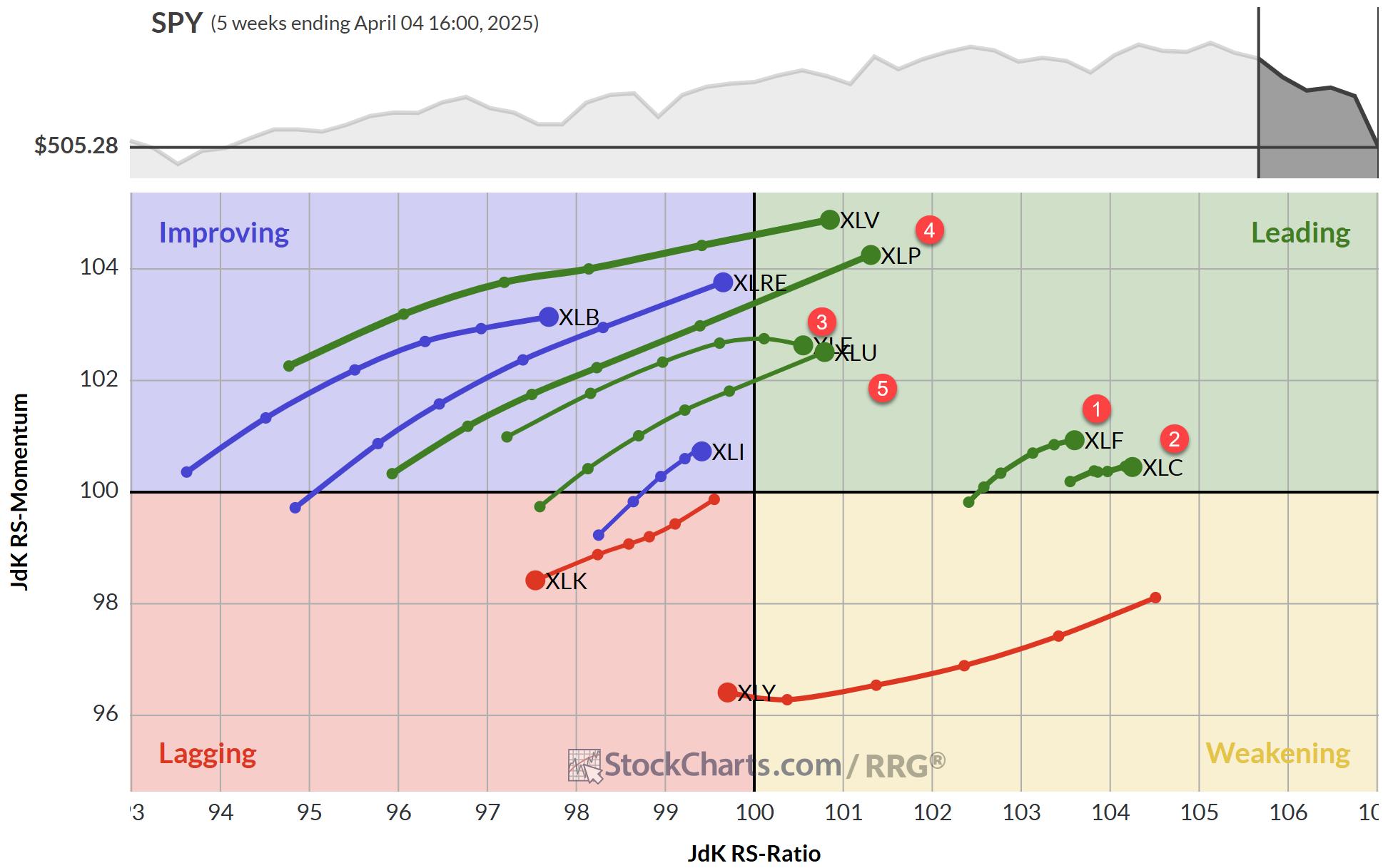

The Best Five Sectors, #14

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Consumer Staples replaces Healthcare in top 5

* More defensive rotation underway

* RRG portfolio remains in line with market performance

This article was first posted on 4/4/2025 and contained only rankings and charts. Then updated with comments 4/7/2025

I am attending and speaking at the...

READ MORE

MEMBERS ONLY

Demystifying Tariff Impact: Essential Insights for Every Investor

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes are all trading below their 100-week moving averages.

* The Bullish Percent Index (BPI) indicates sellers are dominant.

* The AAII Sentiment Survey reveals extreme bearishness among investors.

The stock market hoped for curtailment of tariffs on Wednesday, but that didn't happen. Even...

READ MORE

MEMBERS ONLY

Three Stocks to Watch: Utilities, Banks, Airlines

by Jay Woods,

Chief Global Strategist, Freedom Capital Markets

When markets are sliding lower, where should you be investing? Here are three stocks to consider.

American Water Works (AWK)

Why focus on a utility company that isn't reporting earnings this week? It's because the biggest question of the week is where should you put your...

READ MORE

MEMBERS ONLY

BSX Stock Slump? Discover This Winning Option Strategy

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* BSX stock price has been in a long-term uptrend till February 2025 and has been struggling to regain its upside momentum.

* Boston Scientific stock is approaching its 50-day moving average which could act as a resistance level.

* If the stock price of BSX shows a bearish bias, a...

READ MORE

MEMBERS ONLY

Get Paid to Buy Your Favorite Stocks Using This Options Strategy

by Tony Zhang,

Chief Strategist, OptionsPlay

Did you know you can generate more than a 5% monthly yield by utilizing an options strategy?

In this educational video, Tony Zhang walks you through an income-generating options strategy using the OptionsPlay Strategy Centeron StockCharts.com.

Learn how to select the right stocks, identify strike prices and expiration dates,...

READ MORE